Kilroy’s College has many past and present students who are running their own businesses -from dog groomers, to dressmakers and nutritionists – we have more than sixty courses to help boost career and income prospects. 76% of companies report suffering from at least one type of fraud (Kroll 2015) and economic fraud costs Irish businesses millions of euro each year – so here are a few tips from the experts on how to prevent your business from being a victim of fraud.

Economic Crimes

I was recently invited to a talk on economic crimes which was organised by Siobhan Fitzpatrick from the Women In Business Network and hosted by Bank of Ireland in their Montrose branch. Economic crimes refer to illegal acts committed by an individual or a group of individuals to obtain a financial or professional advantage. In such crimes, the offender’s principal motive is economic gain. Examples would be credit card fraud, invoice re-direct/CEO fraud and counterfeit currency, as well as occupational fraud.

Payment Card, Counterfeit Currency & Invoice Re-direct

This week’s blog post covers the first three items on the agenda: “Payment Card, Counterfeit Currency and Invoice Re-direct”. Next week I will outline the fourth item covered in the talk, namely “Internal Fraud Management Risk”.

The first section of the talk was presented by Detective Garda Niamh Seberry of the Garda National Economic Crime Bureau

Counterfeit Payment Cards

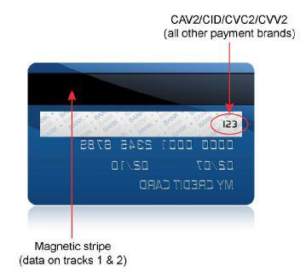

Card information is held on a magnetic stripe on the reverse of the card. Information is skimmed from the magnetic stripe and encoded onto another magnetic stripe by criminals. The skimming device would be put on an ATM or on a card terminal – sometimes a bogus card maintenance engineer would then call into the business and take the information away.

In this way criminals can present a correct payment card which has been re-encoded with the skimmed card’s data. The same can also apply to gift cards (e.g. Dundrum or Brown Thomas gift cards).

Cards can also be coloured, embossed and re-encoded to look like the correct payment card.

Spot the Difference!

One way that the merchant can take preventative action against this is to check that the card number being used matches the number that comes up on the card processing terminal. You will find with the majority of counterfeit payment cards that these numbers will not be the same.

Alternative Card Fraud

There are 4 types of alternative card fraud:

- Card not present – i.e. it has been used for a phone or online purchase.

- Card switch at terminal – i.e. the initial transaction has been cancelled and the compromised card data is entered manually

- Unsolicited calls requesting card information – a caller would typically pretend to be calling from a legitimate payments company (e.g. Verifone) and they would give you the last card number that had gone through your system (they know this as they have just purchased something themselves with a card)!

- Card terminal swap out -this practice is done in an attempt to collect credit and/or debit card information from either the merchant’s original equipment or from a modified device that the merchant’s staff may continue to use unawares. Once the credit information is collected, duplicate credit cards are created to sell on the internet and/or make purchases until the activity is detected.

For more information on fraud prevention please see the Banking and Payments Federation of Ireland website

Counterfeit Currency

There are 4 basic elements of authentication: feel, look, tilt, check.

Feel – the paper should feel unique – it is crisp and not limp or waxy. There are also tactile marks on the notes and you can feel the relief of the intaglio printing.

Look – hold the banknote up to the light. You should be able to spot a watermark, a security thread and a see-through register (which should match).

Tilt – look on the reverse side of the banknote. You should see an iridescent stripe. The stripe shines under a bright light and you can see a € symbol inside the stripe together with the value numeral.

You should also see colour-shifting ink – the value numeral looks purple when viewed straight on, but olive green or even brown when viewed at an angle

Check – check all of the above again.

A free training course on handling banknotes can be found on the Central Bank of Ireland’s website.

Invoice re-direct

Two classic examples of this type of fraud would be:

- When a business receives an email supposedly from a supplier containing an instruction to “update banking information”.

- A Financial Officer receives an email supposedly from the CEO to arrange the transfer of funds

Both of these actions would result in funds transferred to a criminals bank account.

How can you protect against invoice re-direct scams?

Always have a contact in the Accounts department of any business that you are working with – phone them, or even better Skype them, to verify.

Check any new email against the last email from the company that you received. Does the header look the same? Does it look real?

What to do when you discover a fraud?

- Try to think “EVIDENCE”

- Move quickly to retain funds or property

- Retain CCTV

- Try to keep the docket/banknote without handling it too much (fingerprints)

- Call Security and your local Garda Station

Want to learn more?

If you are thinking about upskilling with a view to setting up your own business you can get a free information pack and College prospectus here.

Please also feel free to ask any questions by leaving a comment and we will do our best to get back to you.